Joy Snipes

401 W Main St Room 203

PO Box 32

Dillon, SC 29536

Phone: (843)774-1418

Fax: (843)841-3729

Hours of Operation: 8:30 am – 5:00 pm (Monday-Friday)

Email: dilloncountyauditor@dilloncountysc.org

Department Responsibilities

Pursuant to the South Carolina Constitution, the S.C. General Assembly established the Office of Auditor in each of the 46 counties in the state. The Dillon County Auditor’s Office operates under the oversight of the elected Dillon County Auditor.

The Auditor’s Office is responsible for the creation of all real and personal property tax bills in accordance and compliance with state law. The tax billing process includes assembling a complete listing and description of all taxable real and personal property into the official tax record and compiling the property tax millage rates of all governing authorities into an annual millage sheet. Additionally, the Auditor’s Office works with state and local tax authorities in the areas of budgeting, general obligation bonds, tax base certifications, and other required statutory and regulatory reporting matters. In addition, the Auditor’s Office:

- Grants the Homestead Exemption to eligible county residents in the year after they become 65, totally disabled or blind.

- Processes the refund of property taxes when a taxpayer sells his vehicle or moves out of state.

- Makes adjustments to the tax bills when notified by the Assessor or Department of Revenue of corrections in values or new ownership.

- Adjusts vehicle taxes when documentation of high mileage is received.

- Adds penalty charges to property taxes that have not been paid timely.

- Complies year-end assessment reports of all taxable property that is needed by Bond Attorneys, Department of Revenue, County, School Districts or other agencies.

Taxpayer Assistance

The Dillon County Auditor’s Office assists individual taxpayers with property tax issues related to vehicles, watercraft, aircraft, manufacturing, business personal property and vehicle tax exemptions. Assistance is provided in our office or by phone during business hours. You can also contact the Auditor’s Office by mail, fax, or e-mail.

SC Property Taxes & Exemptions

What Is A Millage Rate?

In South Carolina, the state uses a millage rate formula to determine property taxes. Tax rates are determined by local tax authorities by dividing the amount of revenue they need to meet their budget by the total assessed value in the tax jurisdiction. Tax rates are expressed in mills, which is equal to $1 of tax per $1,000 in assessed value.

How Is Millage Or Property Tax Calculated In SC?

If you want to see a blank stare, just ask a taxpayer if he can explain what a mill represents on his tax bill. Admittedly understanding how millage is applied is a complex process.

A mill is the rate of tax used to calculate local property taxes. A tax bill includes a number of technical terms, including millage rate, assessment rate and assessed value.

SC Property Tax Terms

- Appraised value – fair market value of property

- Assessment ratio – percent of fair market value property upon which the tax rate will be applied

- Assessed value – taxable value of property = appraised value x assessment ratio

- Mill – one thousandth of one dollar (1/1,000 per $1)

- Millage or tax rate – tax rate applied to assessed value

How Your Property Taxes Are Calculated?

The South Carolina Constitution sets eight classifications of property, each with a different assessment rate. Legislators established the different rates so owners who earn an income from their property would pay a higher tax.

Therefore, manufacturing property has a 10.5 percent assessment rate and commercial property has a 6 percent rate, while owner-occupied residential property is assessed at 4 percent.

So exactly what is a mill? One mill is equal to one thousandth of a dollar per $1 of assessed property value.

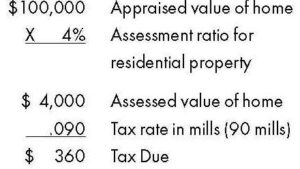

If a city council approves a tax of 90 mills, then the taxpayer will pay $90 per $1,000 of assessed property value. Here is the formula to calculate property taxes:

The value of a mill varies across the cities and towns in South Carolina. The cities with higher total assessed or taxable property values have the highest value per mill. Hilton Head Island’s total assessed property value is $555 million; therefore, the tax value per mill is $910,000. This means the city will collect $910,000 in total property taxes for every mill the council sets as its tax rate.

However, cities with low total property values do not raise as much revenue per mill. For example, the Town of Lane has a total assessed value of $550,000. Lane will collect only $531 per mill.

On average, property tax revenue represents 26 percent of a city’s total revenue. It is an important and stable source of revenue for cities to fund services such as police and fire protection, code enforcement and sanitation services. Councils must balance the needs for city services against the financial resources of their property owners when setting a city’s millage rate.

Overview of Motor Vehicles

Before registering a vehicle in South Carolina, you must pay personal property tax on your vehicle. Vehicle property taxes are based on the value of your vehicle and the tax district in which you live. Please note that car dealerships do not collect county property taxes.

Vehicle taxes are paid twelve months in advance. If you sell or dispose of your vehicles before the end of twelve months, you may be eligible for a refund. If you get a bill for a vehicle you no longer own, please call the Auditor’s Office prior to making any payment.

Click here to view or download the SC Motor Vehicle Policy publication.

Applications, Forms & Information

- Boat Owner’s Address Change

- Boat Residential Status Affidavit

- Boat Value Review

- High Mileage Appeal Form

- High Mileage Chart

- Recreational Vehicle Affidavit

- Vehicle Value Affidavit

- Vehicle Disposal Affidavit

Documents

- How To Register A Vehicle In Dillon County

- South Carolina Department of Motor Vehicles Information

- SC Individual Income Tax Guide

- Assessed Property By SC County (2018)

- SC Tax Collections By County (2018)

- Accommodations Tax By SC County (2016)

- Sales Taxes By SC County

- SC County Millage Cap (2021-2022)

For Historical Year-By-Year Millage Rate Information By County, Visit South Carolina Association of Counties website at: https://www.sccounties.org/research-information/property-tax-rates

For Historical Year-By-Year Millage Rate Cap Information, Visit The South Carolina Association of Counties website at: https://www.sccounties.org/research-information/millage-caps

Links

- South Carolina Department of Revenue

- SC Department of Revenue Publications For Personal & Business

- SC Department of Revenue Personal Income Tax Guide

- Business Personal Property Guide

- Property Exemptions For Veterans

- Homeowners Guide To Legal Residence In SC

- Moving To SC Guide

- SC Policy Manuals

- Dillon County Community Profile

- 2020 US Census Data By SC County

- South Carolina Office of the State Auditor

2024 Dillon County Council Meeting Schedule

January 1, 2024

Farmers Market Has Permanent Home

According to the USDA, “Farmers markets have become a critical ingredient to our nation’s economy, food systems, and communities. Connecting rural to urban, farmer to consumer, and fresh ingredients to our diets, farmers markets are becoming economic and community...

Equus Announces Sale of I-95 Inland Port

DILLON COUNTY, SC – February 3, 2022 – Equus Capital Partners, Ltd. (“Equus”), one of the nation’s leading developers and private real estate investment managers, announced the sale of 95 Inland Port Logistics Center, a 373,100 square foot warehouse logistics facility...

2024 Dillon County Government Holiday Schedule

January 1, 2024

Finklea & Moody Elected County Council Chair and Vice-Chair

Councilman T.F. “Buzzy” Finklea, Jr. was elected chairman, and Councilman Harold Moody was elected vice-chairman of the Dillon County Council at a recent meeting. This is the only vote of council taken by secret ballot. Chairman was the first to be taken up. Finklea...

Rep. Hayes Announces $5.2 Million For Stormwater Infrastructure Improvements

Rep. Jackie Hayes has announced that Dillon County will be getting $5.2 million for stormwater infrastructure improvements in Dillon County and the City of Dillon. The South Carolina Office of Resilience’s (SCOR) Disaster Recovery Office (DRO) Community Development...

Druscilla Blakely, Clerk To Council

Dillon County Administration

109 S 3rd Avenue

P.O Box 449

Dillon, SC 29536

Phone: (843) 774-1401

Fax: (843) 774-1443

Email: dblakely@dilloncountysc.org

County Council Meetings

Dillon County Council meets on the 4th Wednesday of each month beginning at 5 p.m. unless otherwise changed due to holidays. From time to time, Council approves a special called meeting. All special called meetings will be advertised in the local press and will also be posted on the County website and at the County Administration Building and Council Chambers.

2024 Dillon County Council Regular Called Meeting Schedule

Council Meets 4th Wednesday at 5 p.m.

Wednesday, January 24, 2024

Wednesday, February 28, 2024

Wednesday, March 27, 2024

Wednesday, April 24, 2024

Wednesday, May 22, 2024

Wednesday, June 26, 2024

Wednesday, July 24, 2024

Wednesday, August 28, 2024

Wednesday, September 25, 2024

Wednesday, October 23, 2024

Wednesday, November 20, 2024

Wednesday, December 18, 2024

County Council Meeting Place

County Council holds all meetings unless specified otherwise at the Dillon County Administration Building, Council Chambers, 109 S 3rd Avenue, Dillon, SC 29536

Requests To Address County Council

Should any person, group or organization request to be heard upon any matter at a regular or special meeting of Council, such person, group or organization shall submit a written request to the Chairman of County Council to place such matter on the agenda for the meeting at least seven (7) days prior to the date set for such meeting. The request shall specifically state the reason for the appearance.

The written request should be sent by USPS mail, hand delivered, or faxed to the Clerk to County Council. To make a request or for more information contact:

Druscilla Blakely, Clerk to Council

109 S 3rd Avenue

P.O Box 449

Dillon, SC 29536

Phone: (843) 774-1401

Fax: (843) 774-1443

Email: dblakely@dilloncountysc.org

2024 Council Agendas & Minutes

| Date | Agenda | Minutes |

|

January 24, 2024 |

Agenda |

|

February 6, 2024 Agenda Minutes

2023 Council Agendas & Minutes

| Date | Agenda | Minutes |

|

January 3, 2023 |

Agenda | |

| January 11, 2023 | Agenda | Minutes |

| January 20, 2023 | Agenda | Minutes |

| January 25, 2023 | Agenda | Minutes |

| February 22, 2023 | Agenda | Minutes |

| March 23, 2023 | Agenda | Minutes |

| April 26, 2023 | Agenda | Minutes |

| May 9, 2023 | Agenda | Minutes |

| May 16, 2023 | Agenda | Minutes |

| May 24, 2023 | Agenda | Minutes |

| June 28, 2023 | Agenda | Minutes |

| July 7, 2023 | Agenda | Minutes |

| July 26, 2023 | Agenda | Minutes |

| August 11, 2023 | Agenda | Minutes |

| August 17, 2023 | Agenda | Minutes |

| August 23, 2023 | Agenda | Minutes |

| August 29, 2023 | Agenda | Minutes |

| September 27, 2023 | Agenda | Minutes |

| October 2, 2023 | Agenda | Minutes |

| October 10, 2023 | Agenda | Minutes |

| October 20, 2023 | Agenda | Minutes |

| October 25, 2023 | Agenda | Minutes |

| November 9, 2023 | Agenda | Minutes |

|

November 15, 2023 |

Agenda | |

|

December 13, 2023 |

Agenda |

Minutes |

2022 Council Agendas & Minutes

| Date | Agenda | Minutes |

| January 26, 2022 | Agenda (PDF) | Minutes |

| February 1, 2022 (Called) | Agenda | Minutes |

| February 9, 2022 (Called) | Agenda | Minutes |

| February 23, 2022 | Agenda | Minutes |

| March 23, 2022 | Agenda | Minutes |

| April 19, 2022 | Agenda | Minutes |

| April 27, 2022 | Minutes | |

| May 25, 2022 | Agenda | Minutes |

| June 22, 2022 | Agenda | Minutes |

| July 20, 2022 | Agenda | Minutes |

| July 27, 2022 | Agenda | Minutes |

| August 16, 2022 | Agenda | Minutes |

| August 24, 2022 | Agenda | Minutes |

| September 15, 2022 | Agenda | Minutes |

| September 28, 2022 | Agenda | Minutes |

| October 5, 2022 | Agenda | Minutes |

| October 26, 2022 | Agenda | Minutes |

| November 9, 2022 | Agenda | Minutes |

| November 16, 2022 | Agenda | Minutes |

| December 5, 2022 | Agenda | Minutes |

| December 14, 2022 | Agenda | Minutes |

For agendas and minutes prior to 2022 you can click on the link below and go to the Dillon County Council Agendas & Minutes Archive Page.

The Dillon County Council has the power to create Boards and Commissions that assist the Council and staff with work important to the citizens of Dillon County. Dillon County Council appoints members of each Board or Commission. Many Boards, Commissions, or Committees are created so that each of the 7 Council members appoint a member so that each of the 7 Districts of the County are represented. Each Board, Commission, or Committee has its own mission, rules, and regulations as set and approved by County Council.

The current Boards & Commission are:

- Dillon County Airport Commission

- Dillon County Library Board of Trustees

- Dillon County Planning Commission

- Dillon County Zoning Board of Appeals

- Dillon County Public-Private Economic Development Partnership Board

- Dillon County Transportation Committee

- Dillon County Conversation District

Interested In Serving On A County Board, Commission or Committee?

Any citizen of Dillon County can request and apply to serve on any of the Boards, Commissions, or Committees. County Council has final say on those selected for each vacancy, but all applications will be reviewed and considered. If interested in serving on one of the Dillon County Boards, Commissions, or Committees contact your Council member or the Clerk To Council at:

Druscilla Blakely, Clerk To Council

Dillon County Administration

109 S 3rd Avenue

P.O Box 449

Dillon, SC 29536

Phone: (843) 774-1401

Fax: (843) 774-1443

Email: dblakely@dilloncountysc.org

County Council Member Contact Information

|

District 1 707 Curry Street |

District 2 301 Horseshoe Drive

|

District 3 2552 Harlee Bridge Rd |

|

District 4 PO Box 173 |

District 5 1948 Hwy 301 N

|

District 6 945 W Calhoun St Ext

|

|

District 7 1101 East Harrison St |

District 1

District 1

Jamal Campbell,

Vice-Chairman

707 Curry Street

Dillon, SC 29536

Phone: 910-644-2893

Emails

jamal_campbell24@yahoo.com

jcampbell@dilloncountysc.org

District 5

District 5

Kenny Cook Jr.

1948 Hwy 301 N

Dillon, SC 29536

Phone: 843-610-9780

Email:

kcook@dilloncountysc.org

Your content goes here. Edit or remove this text inline or in the module Content settings. You can also style every aspect of this content in the module Design settings and even apply custom CSS to this text in the module Advanced settings.

District 2

District 2

Dennis Townsend

301 Horseshoe Drive

Lake View, SC 29563

Phone: 843-621-4478

Emails:

dennistownsend@bellsouth.net

dtownsend@dilloncountysc.org

Your Title Goes Here

Your content goes here. Edit or remove this text inline or in the module Content settings. You can also style every aspect of this content in the module Design settings and even apply custom CSS to this text in the module Advanced settings.

District 3

District 3

Detrice Dawkins,

Council Chairwoman

2552 Harlee Bridge Rd

Hamer, SC 29547

Phone:843-617-3425

Emails:

tricedawkins@yahoo.com

dmdawkins@dilloncountysc.org

Your Title Goes Here

Your content goes here. Edit or remove this text inline or in the module Content settings. You can also style every aspect of this content in the module Design settings and even apply custom CSS to this text in the module Advanced settings.

District 4

District 4

T. F. Finklea

PO Box 173

Latta, SC 29565

Phone: 843-752-5017

Cell: 843-632-1266

Emails:

dccbuzzyfinklea@gmail.com

tffinklea@dilloncountysc.org

Your Title Goes Here

Your content goes here. Edit or remove this text inline or in the module Content settings. You can also style every aspect of this content in the module Design settings and even apply custom CSS to this text in the module Advanced settings.